Home

Xin chào Chúng tôi cung cấp dịch vụ Flycam chuyên nghiệp

Vietflycam

Sáng tạo để trường tồn

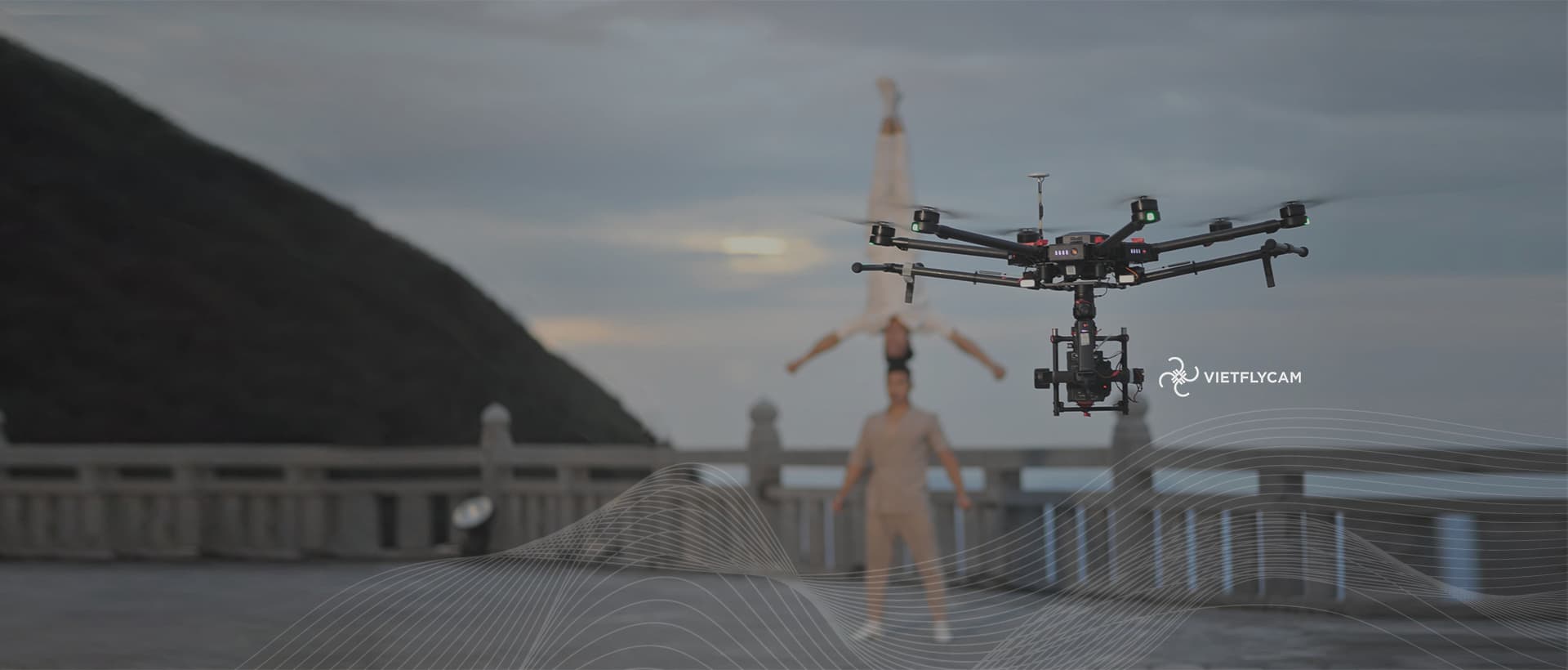

Viet-Flycam là công ty hàng đầu trong nghiên cứu, ứng dụng, phát triển và cung cấp các dịch vụ - giải pháp công nghệ 4.0 về máy bay không người lái và hình ảnh trên không cho các cá nhân và tổ chức chuyên nghiệp

Xin chào Chúng tôi cung cấp dịch vụ Flycam chuyên nghiệp

Góc nhìn Viet-Flycam

Mang đến những trải nghiệm mới lạ, những hình ảnh ngoạn mục, những cảnh quay ấn tượng được chăm chút qua từng góc máy Flycam chất lượng, góp phần đưa dấu ấn Việt Nam lên một tầm cao mới

Xin chào Chúng tôi cung cấp dịch vụ Flycam chuyên nghiệp

Khảo sát và thành lập bản đồ chuyên nghiệp

Gói giải pháp toàn diện và hữu dụng nhất trên thị trường dành cho bay quét, khảo sát và thành lập bản đồ

Vietflycam Sáng tạo để trường tồn

Viet-Flycam là công ty hàng đầu trong nghiên cứu, ứng dụng, phát triển và cung cấp các dịch vụ - giải pháp công nghệ 4.0 về máy bay không người lái và hình ảnh trên không cho các cá nhân và tổ chức chuyên nghiệp

Góc nhìn Viet-Flycam

Gói giải pháp toàn diện và hữu dụng nhất trên thị trường dành cho bay quét, khảo sát và thành lập bản đồ

Khảo sát và thành lập bản đồ chuyên nghiệp

Gói giải pháp toàn diện và hữu dụng nhất trên thị trường dành cho bay quét, khảo sát và thành lập bản đồ

Previous

Next

DỊCH VỤ MÁY BAY KHÔNG NGƯỜI LÁI Viet-Flycam

Viet-Flycam được đồng hành sáng lập bởi Viện nghiên cứu công nghệ Không Gian và Dưới nước – Đại Học Bách Khoa Hà Nội và được điều hành bởi những người đam mê với Máy bay không người lái cùng các chuyên gia về công nghệ không gian và hình ảnh. Chúng tôi luôn nỗ lực để phát triển các giải pháp và xây dựng những nền tảng mới, giúp các ứng dụng của máy bay không người lái trở nên dễ tiếp cận, đáng tin cậy, dễ dàng sử dụng và góp phần cải tiến quy trình làm việc của nhiều lĩnh vực trong cuộc sống.

Chúng tôi cung cấp các giải pháp

01

Trắc địa số và thành lập bản đồ

Viet-Flycam cung cấp các giải pháp máy bay không người lái: bay quét 3D, trắc địa số và thành lập bản đồ một cách toàn diện.

02

Quay phim, chụp hình bằng Flycam

Viet-Flycam tạo ra các giải pháp hình ảnh sáng tạo cho thế hệ nhà làm phim mới.

03

Scan 3D - Khảo sát hiện trạng

Ứng dụng trong quét 3D vào đa dạng các lĩnh vực, xác định chính xác hiện trạng và khai thác nguồn tài nguyên

04

Nền tảng lưu trữ, hiển thị dữ liệu số

Hệ thống phần mềm hiển thị dữ liệu bản đồ trực tuyến lớn nhất và duy nhất đã từng được triển khai tại Việt Nam.

Các lĩnh vực chúng tôi chuyên về

Truyền thông, giải trí, phim ảnh

Chụp ảnh, quay phim điện ảnh, phim truyền hình từ trên cao ghi lại những hình ảnh ngoạn mục, những thước phim bao quát, sắc nét và đầy ấn tượng.

Khảo sát địa hình và thành lập bản đồ

Khảo sát địa hình với độ chính xác, chi tiết cao. Đo đạc, tính diện tích, thể tích và khoảng cách với các dạng bản đồ 2D, 3D, bản đồ kỹ thuật được thành lập.

Xây dựng

Cung cấp dữ liệu khảo sát, mô hình 3D, toàn cảnh VR360 chi tiết, chính xác cho các kiến trúc sư và nhà thầu để đánh giá dự án và phát triển thiết kế.

Bảo tồn di sản, di tích

Bay quét 3D tạo ra các mô hình 3D của vật thể, công trình kiến trúc, di tích lịch sử giúp tối ưu hiệu quả việc nghiên cứu, bảo tồn và khôi phục các di tích.

Du lịch

Bay quét 3D tạo ra các mô hình 3D của vật thể, công trình kiến trúc, di tích lịch sử giúp tối ưu hiệu quả việc nghiên cứu, bảo tồn và khôi phục các di tích.

Công nghiệp, nông nghiệp

Theo dõi thiết bị và tự động hóa công nghiệp. Bộ giải pháp phục vụ truy xuất nguồn gốc, theo dõi giám sát sinh trưởng nhờ ứng dụng công nghệ thực tế ảo.

Những nơi Viet-Flycam đã đặt chân đến

Hồ Chí Minh

Hội An

Cần Thơ

Đà Nẵng

Add Your Tooltip Text Here

Huế

Add Your Tooltip Text Here

Hải Phòng

Add Your Tooltip Text Here

Phú Quốc

Add Your Tooltip Text Here

Buôn Ma Thuột

Add Your Tooltip Text Here

Khách hàng

Dự án

hoàn thành

năm

Hoạt động

quốc gia

Thông qua các giải pháp, công nghệ và dịch vụ truyền thông tối ưu, Viet-Flycam mong muốn tạo ra những sản phẩm chất lượng, góp phần quảng bá hình ảnh đất nước con người Việt Nam ra toàn thế giới.

Copyright ©2023 Vietflycam by I&I Hitech. All Rights Reserved.